Want to know something important you probably don’t check on nearly as often as you should? The value of your home.

Here’s the truth: your house is likely your biggest financial asset. And if you’ve owned it for a few years or more, chances are it’s been quietly building wealth for you in the background – even if you haven’t been tracking it closely. You might be surprised by just how much it’s grown, especially given how the market has shifted recently.

What Is Home Equity?

That hidden wealth is called equity. It’s simply the difference between your home’s current value and what you still owe on your mortgage. Your equity grows over time as property values rise and as you continue making monthly payments.

For example, let’s say your home is worth $500,000 today, and you still owe $200,000 on your mortgage. That means you have $300,000 in equity. And that’s right in line with the typical homeowner right now.

According to Cotality, the average homeowner with a mortgage has about $302,000 in equity.

Why You Likely Have More Equity Than You Think

There are two big reasons homeowners today are sitting on near-record levels of equity:

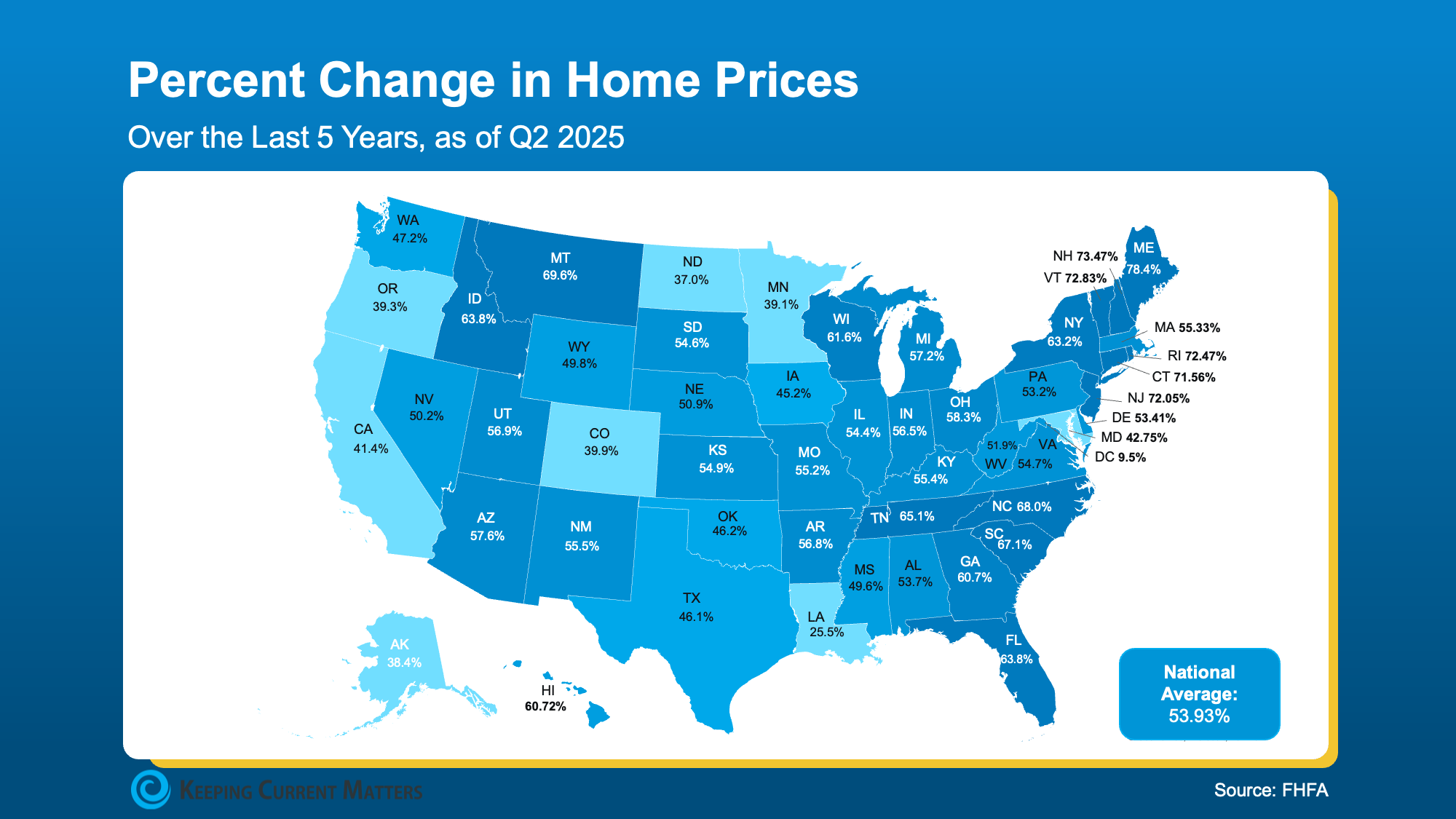

Significant Home Price Growth – According to the Federal Housing Finance Agency (FHFA), home prices have risen nearly 54% nationwide in just the past five years (see map below).

This means your home is probably worth a lot more today than when you first purchased it, simply because prices have climbed so much over time. And even if you’ve heard that prices are flattening or dipping in certain markets, if you’ve owned your home for several years, chances are you’ve built up enough equity to sell and still walk away ahead.

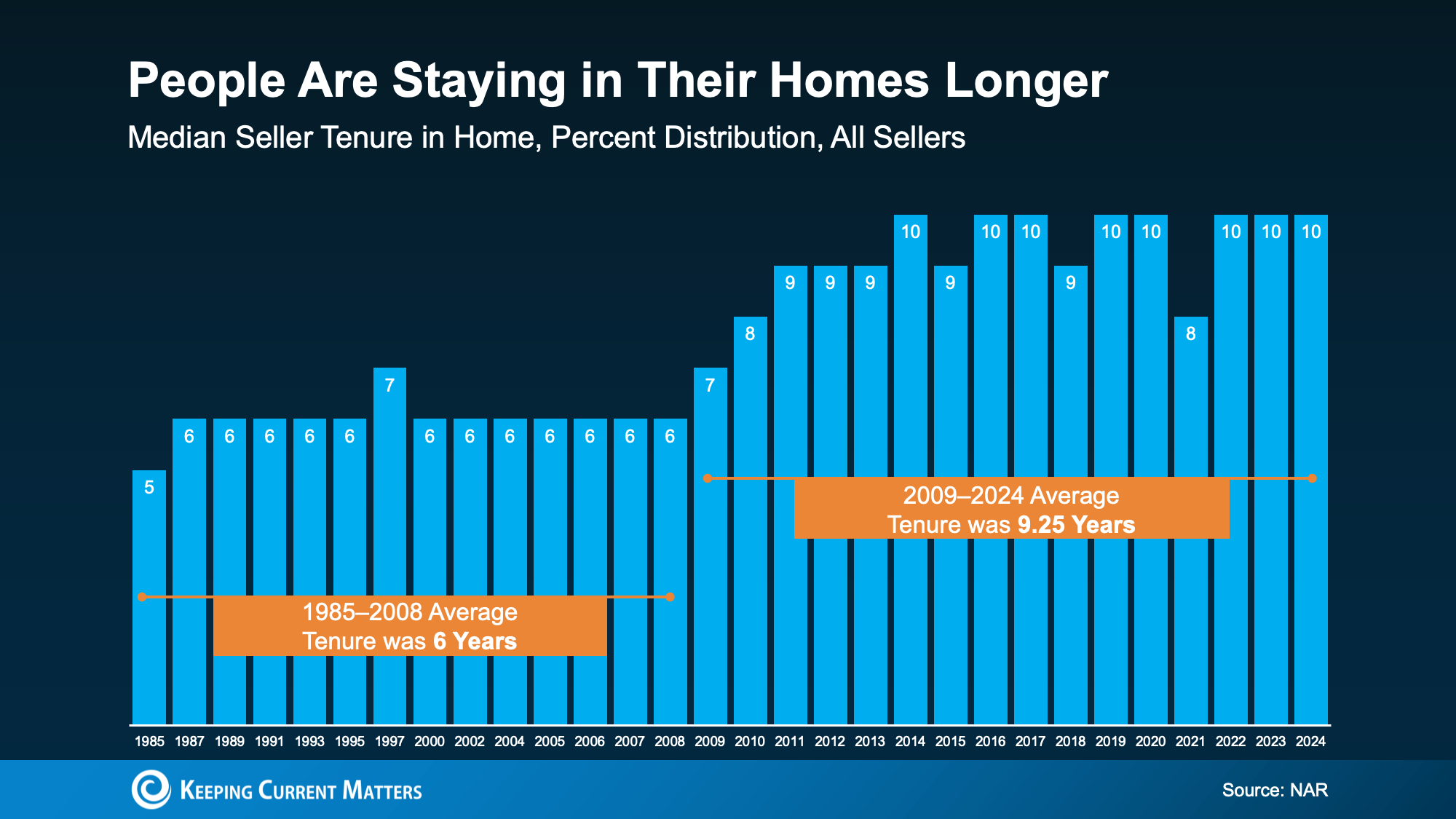

People Are Staying in Their Homes Longer – According to data from the National Association of Realtors (NAR), the average homeowner now lives in their home for about 10 years (see graph below). The longer you stay put, the more time you have to pay down your loan balance and benefit from home price appreciation—both of which grow your equity.

That’s longer than it used to be. And over that decade, you’ve built equity just by paying down your mortgage and riding the wave of rising home values. Homeownership is really about playing the long game—not stressing over the short-term ups and downs of the market. And over time, that’s how you win.

In fact, if you’ve been in your home for a while, here’s how much those behind-the-scenes gains have worked in your favor. According to NAR:

“Over the past decade, the typical homeowner has accumulated $201,600 in wealth solely from price appreciation.”

What Could You Actually Do with That Equity?

Your equity isn’t just a number—it’s a powerful tool you can put to work, depending on your goals:

Buy your next home – Your equity could cover the down payment on your next place—or even give you the chance to purchase in all cash.

Renovate and reinvest – Upgrade your current home to fit your lifestyle. Done strategically, those projects could also boost your home’s resale value down the line.

Fund a new opportunity – Whether it’s starting a business, investing, or pursuing a big dream, tapping into your equity could give you the financial head start you need.

Bottom Line

Chances are, your home is worth more than you think. If you’re curious about your equity and what it could mean for your next move, connect with a trusted local agent to get the numbers. That way, you’ll know exactly what you’re working with—and where it could take you.